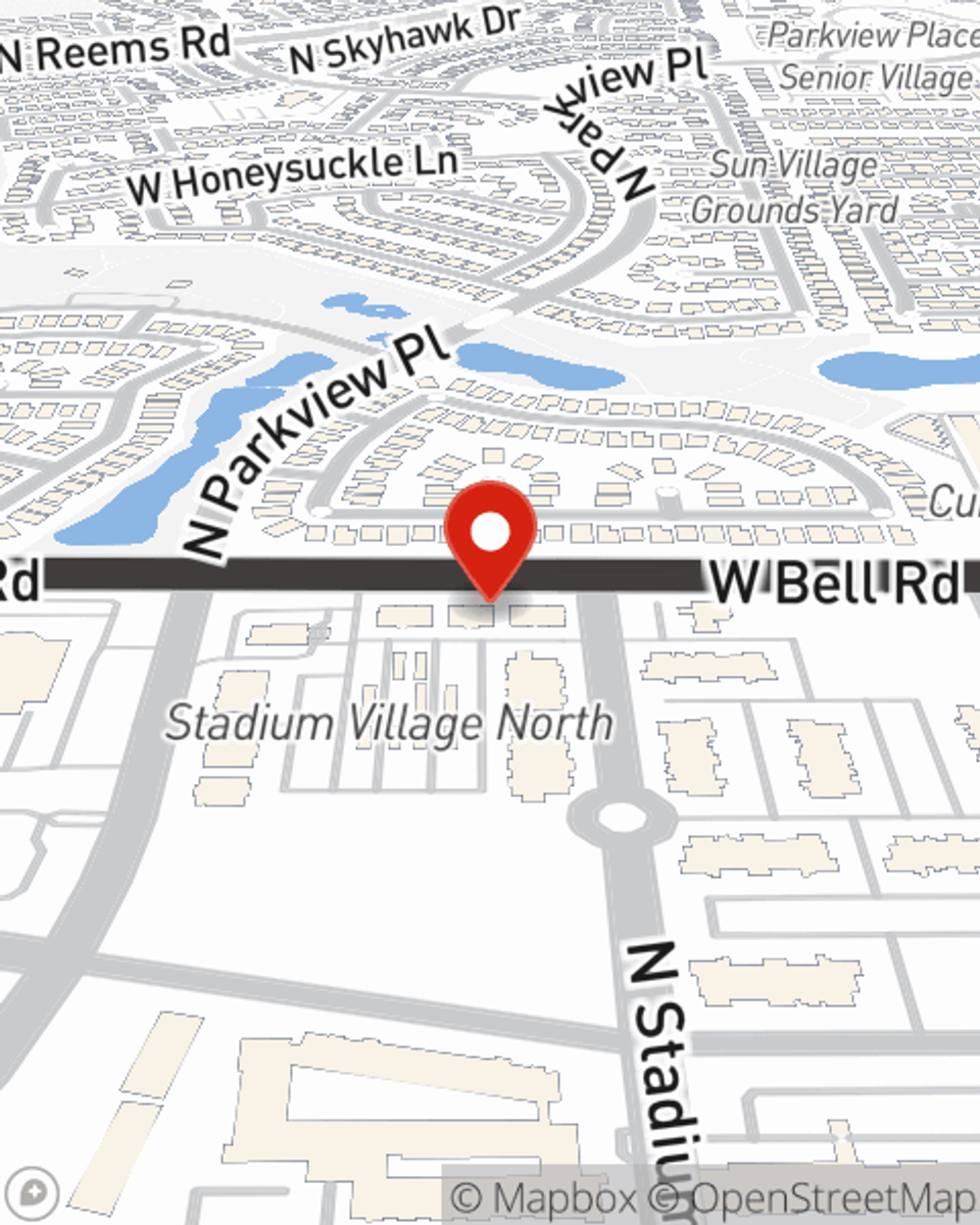

Condo Insurance in and around Surprise

Condo unitowners of Surprise, State Farm has you covered.

State Farm can help you with condo insurance

- Phoenix

- Sun City

- El Mirage

- Peoria

- Glendale

- Paradise Valley

- Scottsdale

- Wickenburg

- Waddell

- Cave Creek

- Anthem

- Maryvale

- Sun City Festival

- Tartesso

- Tempe

- Surprise

- Sun City West

- Litchfield Park

- Avondale

- Goodyear

- Buckeye

- Estrella

- Laveen

- Tolleson

Your Possessions Need Protection—and So Does Your Condo.

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from smoke, weight of sleet, or lightning.

Condo unitowners of Surprise, State Farm has you covered.

State Farm can help you with condo insurance

Protect Your Home Sweet Home

Despite the possibility of the unexpected, the future looks bright when you have the terrific coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your condominium and personal property inside, you'll also want to check out liability coverage bundling, and more! Agent Lisa RO Ross can help you generate a plan based on your needs.

Terrific coverage like this is why Surprise condo unitowners choose State Farm insurance. State Farm Agent Lisa RO Ross can help offer options for the level of coverage you have in mind. If troubles like identity theft, wind and hail damage or drain backups find you, Agent Lisa RO Ross can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Lisa RO at (623) 974-2600 or visit our FAQ page.

Simple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Lisa RO Ross

State Farm® Insurance AgentSimple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.